Nelson makes the case that “spurious” or statistically insignificant correlations mined from ambiguous past data aren’t just a danger for individual investors or investment managers, but in an era of unprecedented volatility, these strategies will continue to increase the market’s erratic tendencies (especially in the uncertain age of Covid-19). Nelson proposes instead that greater returns—and greater market stability—would come from resuming strategies based on enterprise valuation, with an emphasis on forward-looking causal data and companies’ available cash assets.

This second edition is updated with a hefty prologue that invites readers to evaluate Nelson’s track record. He surveys the relative stability of his Valuentum stocks—stocks that meet the criteria of his 15-point checklist—over the course of 2020, demonstrating them to have been at least “pandemic-resistant” when not “pandemic-proof.” Readers eager for a simple investing system may find Nelson’s thorough case-making frustrating, but this work was conceived as a cry for economic stability, not an entry-level guide, and more experienced investors will find it thought-provoking and worth their time.

Takeaway: Readers steeped in the stock market will appreciate this persuasive economic treatise, which sounds the alarm on spurious quantitative analysis.

Great for fans of Aswath Damodaran’s The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit; Richard Barker’s Determining Value: Valuation Models and Financial Statements.

Production grades

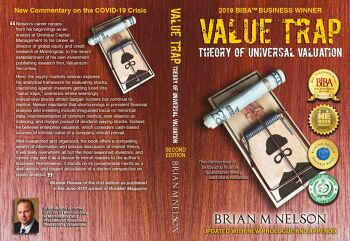

Cover: A-

Design and typography: A

Illustrations: –

Editing: B+

Marketing copy: A